Optimizing Accounts Receivable Turnover for Success in Manpower Industry

- trienkhaiweb

- 22 December, 2025

- 0 Comments

In the competitive landscape of Vietnam’s manpower industry, financial health is paramount. For businesses like Quinn Vietnam Manpower, ensuring a healthy cash flow is essential for operational efficiency, growth, and maintaining a strong reputation. A key metric to monitor in this regard is Accounts Receivable Turnover. This article delves into the importance of accounts receivable turnover, its calculation, interpretation, and strategies to optimize it for success in the manpower sector.

What is Accounts Receivable Turnover?

Accounts Receivable Turnover is a financial ratio that measures how efficiently a company collects its outstanding invoices. In simpler terms, it indicates how many times a business converts its credit sales into cash within a specific period, typically a year. This metric is crucial for manpower agencies like Quinn Vietnam Manpower as it directly impacts their liquidity and ability to meet financial obligations.

Why is Accounts Receivable Turnover Important for Manpower Businesses?

- Cash Flow Management: A healthy accounts receivable turnover ensures a steady inflow of cash, which is vital for manpower businesses to cover operational expenses such as salaries, marketing, and office rent.

- Financial Stability: Efficient debt collection minimizes the risk of bad debt and strengthens the company’s financial position, enabling it to invest in growth initiatives and attract potential investors.

- Operational Efficiency: A high turnover ratio suggests that the company has robust credit and collection policies in place, leading to smoother operations and reduced administrative burden.

- Competitive Advantage: Maintaining a strong accounts receivable turnover can give manpower agencies like Quinn Vietnam Manpower a competitive edge by demonstrating financial stability and reliability to clients and candidates.

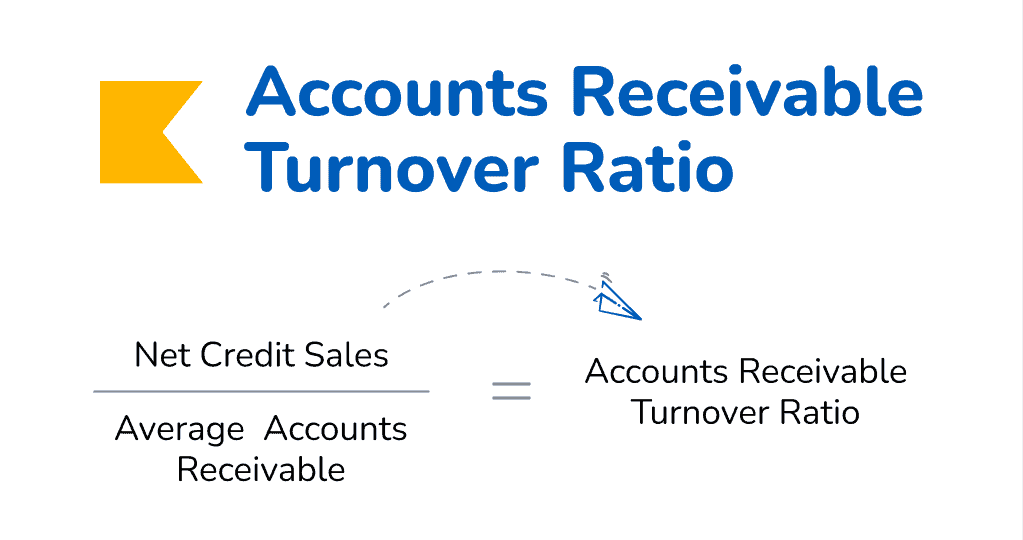

Calculating Accounts Receivable Turnover

The formula for calculating accounts receivable turnover is straightforward:

Accounts Receivable Turnover = Net Credit Sales / Average Accounts Receivable

- Net Credit Sales: This refers to the total revenue generated from credit sales during the period, excluding any sales returns or allowances.

- Average Accounts Receivable: This is calculated by adding the accounts receivable balance at the beginning of the period to the balance at the end of the period and dividing the sum by two.

Interpreting Accounts Receivable Turnover

A high accounts receivable turnover generally indicates that a company is efficient in collecting its debts. This means that customers are paying their invoices promptly, and the business has a strong credit policy in place. Conversely, a low turnover ratio may suggest potential issues such as:

- Lenient credit policies: Extending credit too easily or having long payment terms can lead to delayed payments.

- Inefficient collection practices: Lack of follow-up or inadequate communication with clients can result in overdue invoices.

- High-risk customer base: Serving clients with poor credit history can increase the risk of bad debt.

Optimizing Accounts Receivable Turnover for Manpower Businesses in 2025

In the evolving landscape of Vietnam’s manpower industry, optimizing accounts receivable turnover is crucial for sustained success. Here are some strategies that Quinn Vietnam Manpower and other agencies can implement:

- Implement Clear Credit Policies:

Establish clear and concise credit policies that outline credit limits, payment terms, and consequences for late payments. Communicate these policies effectively to clients to ensure transparency and avoid misunderstandings.

- Leverage Technology:

Utilize accounting software and automation tools to streamline invoicing, payment processing, and follow-up procedures. This reduces manual errors, improves efficiency, and allows for real-time tracking of outstanding invoices.

- Offer Diverse Payment Options:

Provide clients with multiple payment options such as online payments, bank transfers, and credit card payments to facilitate prompt payment and cater to diverse preferences.

- Maintain Strong Client Relationships:

Foster open communication and build strong relationships with clients. This enables proactive discussions regarding payment schedules and facilitates prompt resolution of any payment issues.

- Implement a Robust Collection Process:

Develop a systematic collection process that includes timely reminders, follow-up calls, and escalation procedures for overdue invoices. While maintaining professionalism, ensure consistent follow-up to minimize delays.

- Offer Incentives for Early Payment:

Consider offering discounts or other incentives for clients who pay their invoices early. This encourages prompt payment and improves cash flow.

- Regularly Review and Analyze Data:

Continuously monitor and analyze accounts receivable turnover data to identify trends, potential issues, and areas for improvement. This allows for proactive adjustments to credit and collection policies to optimize efficiency.

- Seek Expert Advice:

Consult with financial experts or legal professionals to ensure compliance with relevant regulations and optimize credit and collection practices in accordance with industry best practices.

Quinn Vietnam Manpower: Your Partner in Financial Success

Quinn Vietnam Manpower is committed to supporting businesses in Vietnam’s manpower industry achieve financial success. Our comprehensive services include not only talent acquisition and management but also guidance on financial best practices. We understand the importance of optimizing accounts receivable turnover for sustained growth and stability.

Looking Ahead: Manpower Trends in Vietnam for 2025

As Vietnam’s economy continues to grow, the manpower industry is expected to witness significant transformations in 2025. With increasing demand for skilled professionals and a focus on digitalization, manpower agencies need to adapt and embrace innovative solutions to remain competitive. Quinn Vietnam Manpower is dedicated to staying at the forefront of these trends, providing cutting-edge services that meet the evolving needs of businesses and candidates.

By prioritizing financial health and implementing effective strategies to optimize accounts receivable turnover, manpower businesses can navigate the challenges and capitalize on the opportunities that lie ahead in Vietnam’s dynamic market.

Related articles

Employee Empowerment with Quinn Vietnam Manpower

In today’s dynamic business landscape, organizations are increasingly recognizing the importance of employee empowerment as a key driver of success. Quinn Vietnam Manpower, a leading provider of manpower solutions in Vietnam, understands that empowered employees are more engaged, productive, and committed to organizational goals. This article delves into the concept of employee empowerment, exploring its…

Quinn Vietnam Manpower’s 5 Steps to Successful Coaching in 2025

In today’s dynamic business environment, maximizing your manpower’s potential is crucial for success. Effective coaching programs are key to unlocking this potential, fostering employee growth, and driving organizational performance. Quinn Vietnam Manpower, a leading provider of manpower solutions, presents a comprehensive guide to successful coaching in 2025. Whether you’re leading coaching sessions yourself or partnering…

Functional Skills: A Guide for Quinn Vietnam Manpower’s Workforce in 2025

In today’s competitive job market, possessing strong functional skills is more critical than ever. For Quinn Vietnam Manpower, equipping our manpower resources with these essential skills is key to their success and the success of our partner businesses. This comprehensive guide explores the importance of functional skills, particularly in Math and English, and how Quinn…

Level Up Your Workforce: Gamification Strategies for Quinn Vietnam Manpower

In the competitive landscape of Vietnam’s manpower industry, attracting, engaging, and retaining top talent is more critical than ever. Quinn Vietnam Manpower recognizes the power of innovative solutions, and gamification is emerging as a game-changer in the realm of human resources. By integrating game mechanics and elements into various HR processes, Quinn Vietnam Manpower can…

3 Communication Skills Every Manager Needs to Thrive

In today’s rapidly evolving business landscape, effective communication skills are more critical than ever for managers. Whether you’re a seasoned leader or newly promoted, honing your communication abilities can significantly impact your team’s performance, morale, and overall success. This article delves into three essential communication skills every manager needs to master in 2025 and highlights…

Harnessing the Power of Insights with Quinn Vietnam Manpower

In the dynamic landscape of 2025, where businesses face unprecedented challenges and opportunities, the ability to gain profound insights is more critical than ever. For project management (PM) in Vietnam, this rings especially true. Quinn Vietnam Manpower, a leading provider of manpower solutions, recognizes the crucial role of insights in driving project effectiveness and organizational…